Bank & Insurance

Transform Digital Banking:

One Unified Platform

for Secure Engagement

Your favorite brands,

powered by indigitall

Here´s How We Help

Product Overview - Customer Engagement Like You've Never Seen BeforeReduce Fraud Risk and High SMS Costs

01

- Use encrypted push notifications to securely replace costly and vulnerable SMS communications

- Implement two-factor authentication (2FA) via secure channels like Push, WhatsApp, or RCS

- Leverage real-time monitoring tools to instantly block fraudulent activity and unauthorized access

Reduce High Form Abandonment Rates

02

- Utilize AI chatbots to provide real-time, personalized support and recover abandoned registrations

- Send timely reminders and relevant incentives via omnichannel journeys to convert potential leads

- Implement Web Push Notifications with retargeting and segmentation to recover customers who abandoned forms

Improve Data Collection Challenges

03

- Collect valuable first-party data using personalized web content, dynamic cards, and chatbots

- Motivate users to share information in exchange for tailored, value-driven financial experiences

- Optimize data collection processes using engaging, real-time conversational interactions to convert anonymous visitors

Improve Remarketing and Conversion Rates

04

- Utilize targeted push notifications and segmentation to convert occasional visitors into loyal, registered users

- Deliver timely, personalized financial updates and commercial offers to drive continuous customer engagement

- Implement remarketing strategies via segmented communications to increase website and application traffic

Improve Adoption of Services

05

- Deliver personalized recommendations based on customer behavior and transaction history

- Automate cross-selling and upselling through data-driven customer journey flows and incentives

- Employ targeted segmentation across omnichannel platforms to ensure financial offers are opportune and pertinent

Reduce High Cost of Customer Support

06

- Deploy AI chatbots (including Generative AI) to automate support interactions and reduce operational costs by 40-60%

- Offer 24/7 instant, precise assistance via web, mobile apps, and popular messaging platforms

- Utilize smart escalation to human agents only for complex issues, improving agent efficiency

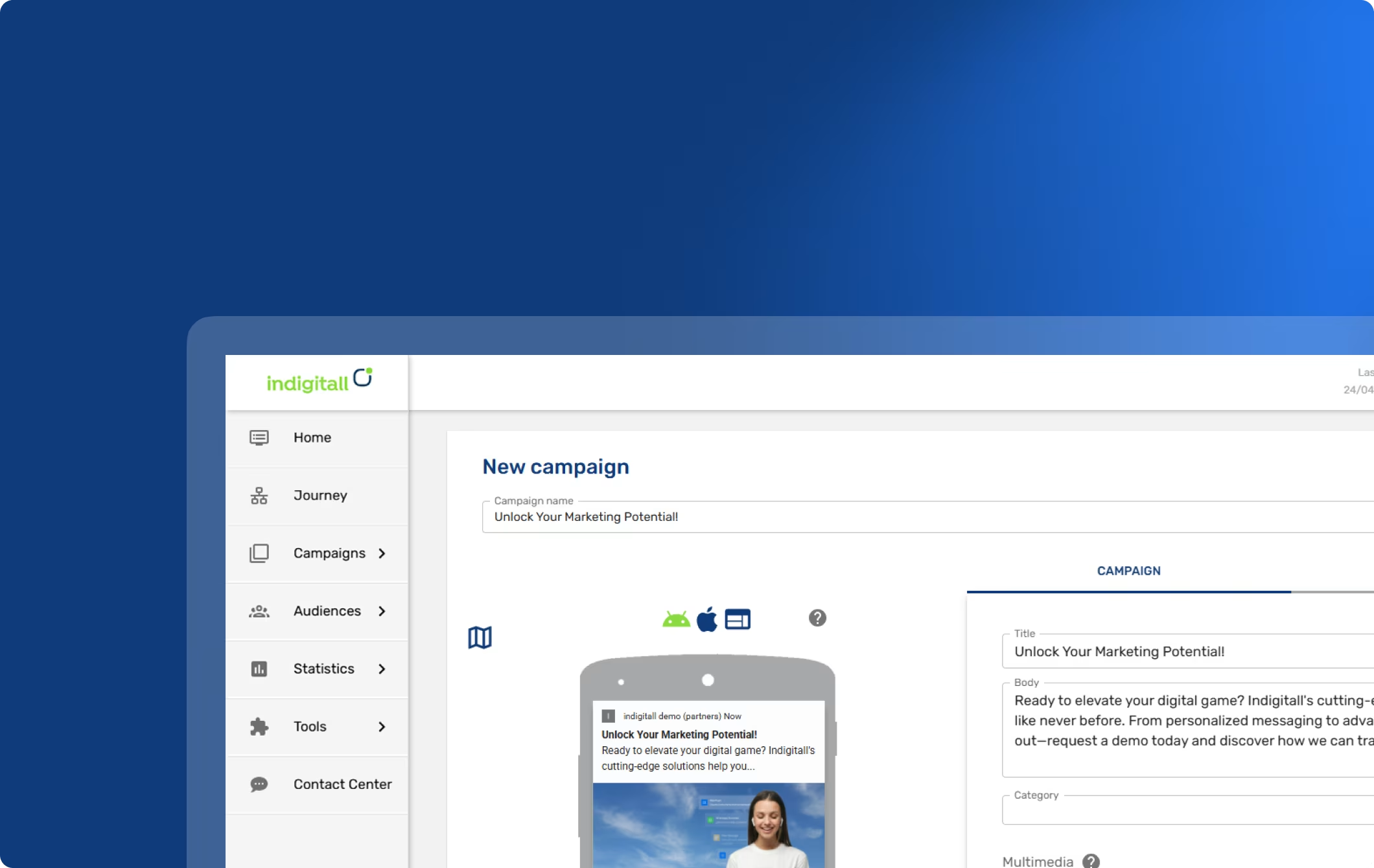

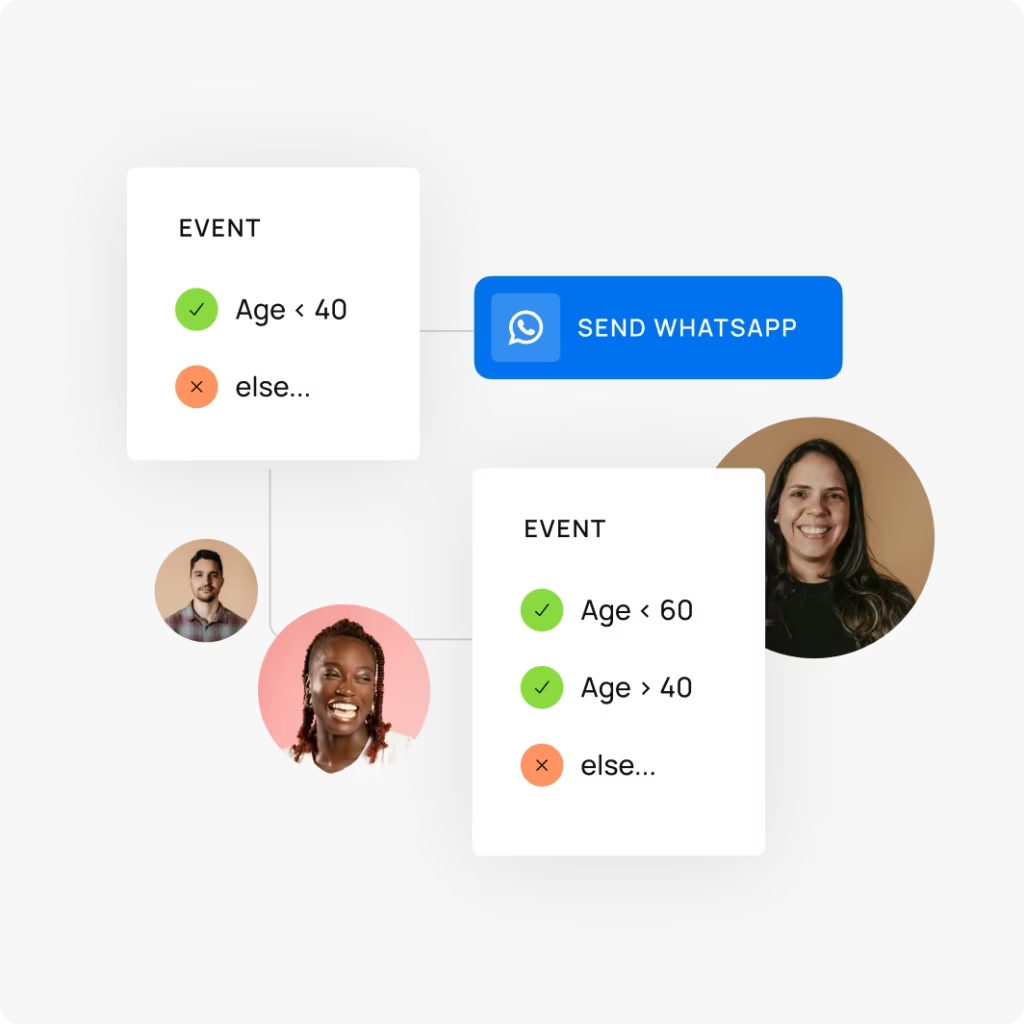

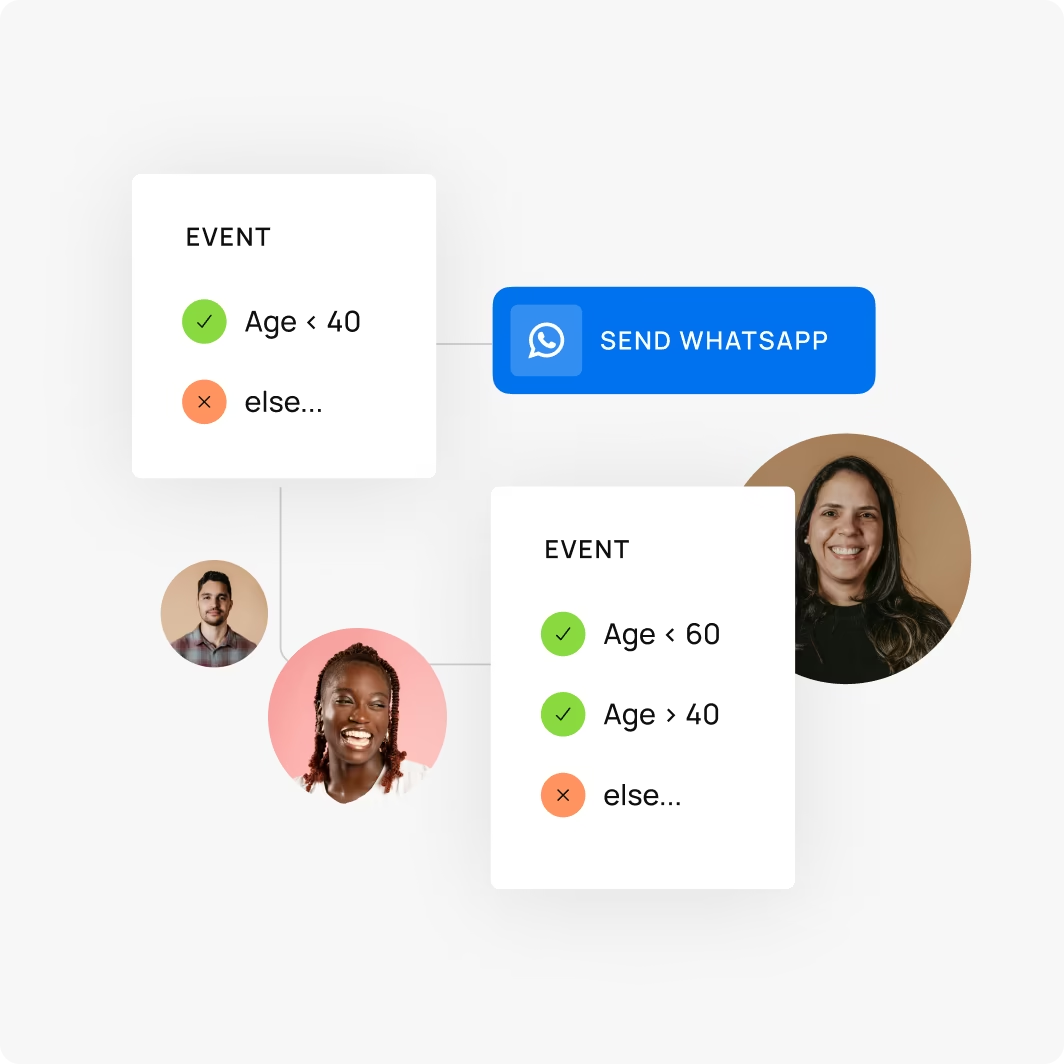

CUSTOMER JOURNEY

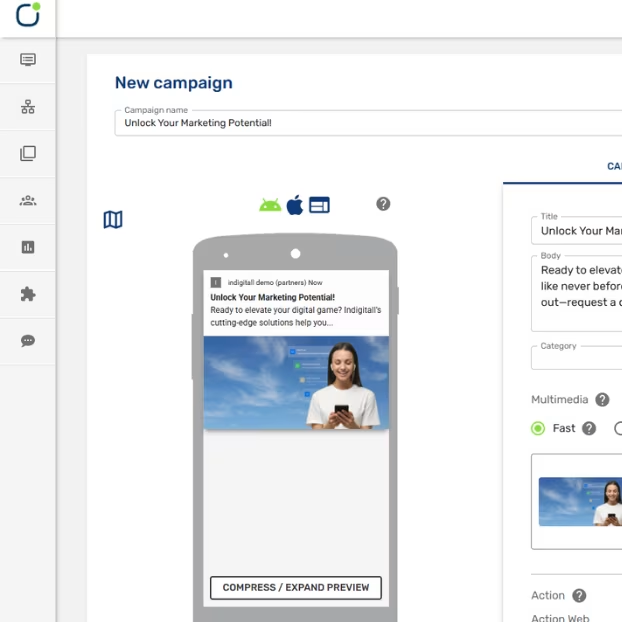

Channel orchestration system? Sounds perfect

Optimize your communications and marketing campaigns from a single platform. AI ensures maximum conversion rates through automation and personalized content on each user's favorite channels.

Marketing Solutions, Just The Way You

And Your Business Want Them

See Product Overview

Encrypted Push

01

Secure customer communication with banking-grade encrypted alerts for transactions, fraud warnings, and account updates. Geo-target time-sensitive offers while reducing SMS costs by 75%.

- Only provider with out-of-box encryption

- 90%+ open rates for critical alerts

- GDPR/PSD2 compliant

- Retargeting/Re-Engagement

Custom Web / inApp

02

Personalize communications to achieve higher conversion rates and improve user satisfaction.

- Acquisition

- Geotargeting

- Loyalty

- Customization

- Interactivity

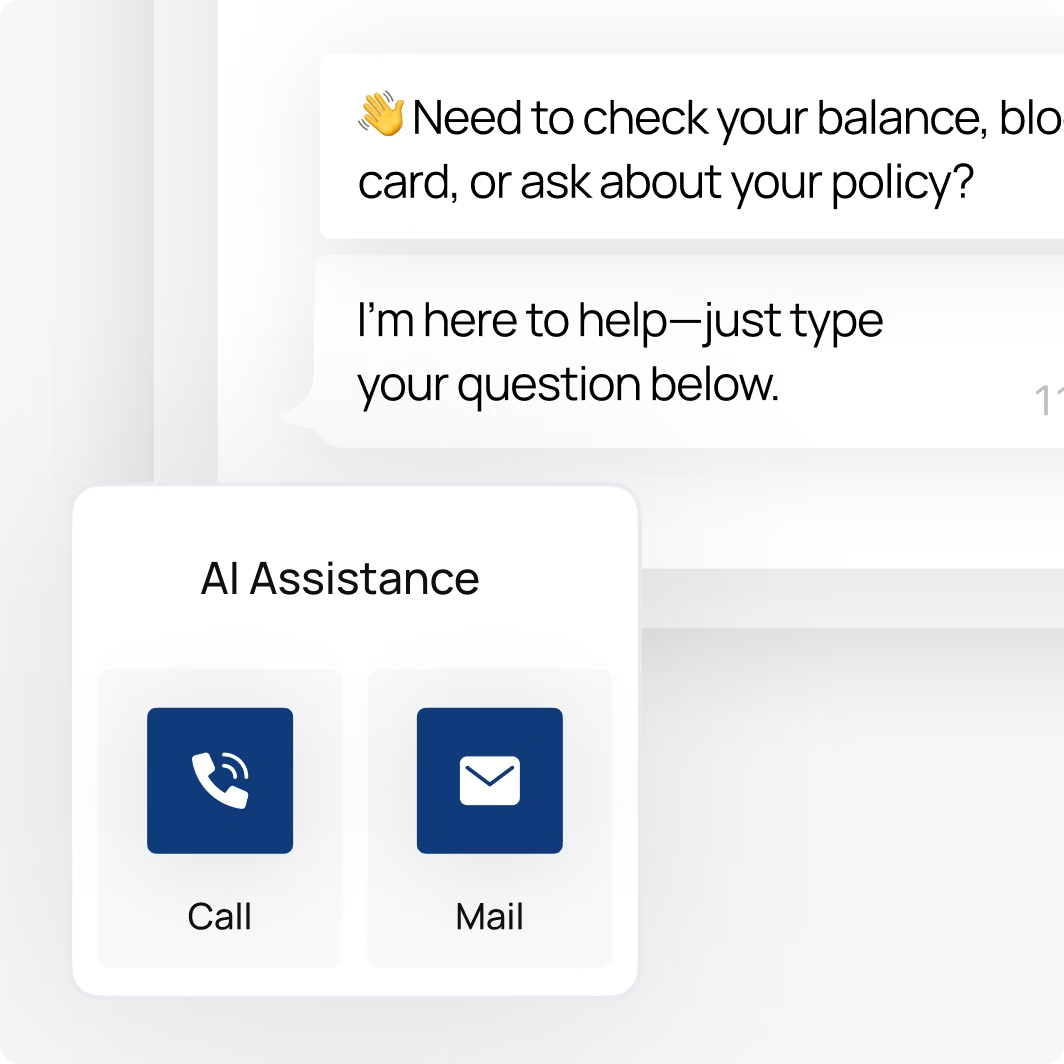

AI Chatbots & Virtual Assistants

03

Resolve 90% of banking queries instantly with 24/7 multilingual support for balance checks, card blocking, and policy FAQs.

- Seamless CRM integration

- 100% accessible

- No opening requirement account

- Fraud detection alerts

- Directly response to user questions and doubts

- Proactive and personalized messages

Web Push Notifications

04

Drive engagement with browser-based alerts for loan approvals, payment reminders, and financial tips—delivered across desktop and mobile.

- 3x higher CTR than email

- Anonymous user targeting

- Real-time personalization

Omnichannel Messaging Hub

05

Unify customer profiles across app, WhatsApp, and SMS to deliver consistent journeys—from onboarding to claims processing.

- 40% higher NPS

- Coordinated cross-channel campaigns

- Maximize customer loyalty

- Improve user experience

The indigitall way

An Easier Way to Make

Data-Driven Decisions

15x

Increase in

sessions per user

32x

Increase in customer

lifetime value

80%

Increase in average

user lifetime

4x

Increase in

purchases per user

Why choose indigitall?